Apply Early!!! Some funds are limited, and the sooner you file the more financial aid you could potentially receive.

The Financial Aid process at Spoon River College is an annual activity beginning October 1 for the following academic year (fall, spring, and summer). The Free Application for Federal Student Aid is required for all federal aid, including grants, Federal Direct student loans, and work study as well as the Illinois Monetary Award Program (MAP). The FAFSA is a free application, you should never have to pay a fee to submit your information.

- Fill out an Admissions Application for SRC

- Submit an official HS transcript or GED scores

- Complete the FAFSA (Free Application for Federal Student Aid)

Gather the documents you need:

Your SS#, DL#, W-2’s, Federal Income Tax return, parent’s Federal Income Tax return (if required), parent’s W-2’s (if required), and any additional untaxed income such as veteran’s benefits, child support, and worker’s compensation.

Apply for an FSA ID:

An FSA ID (username and password) will be used by you to access your FAFSA, sign promissory notes, complete loan entrance and exit counseling and access your grant and loan history on the National Student Loan Data System website. You, along with your parents (if required) will use an FSA ID to sign your FAFSA. Note: Your parents must also apply for an FSA ID, used to sign their portion of your FAFSA (if required). To apply for an FSA ID, go to the Federal Student Aid website .

Spoon River College School Code: 001643

FAFSA Overview

Applying for the FAFSA is only the First Step!!

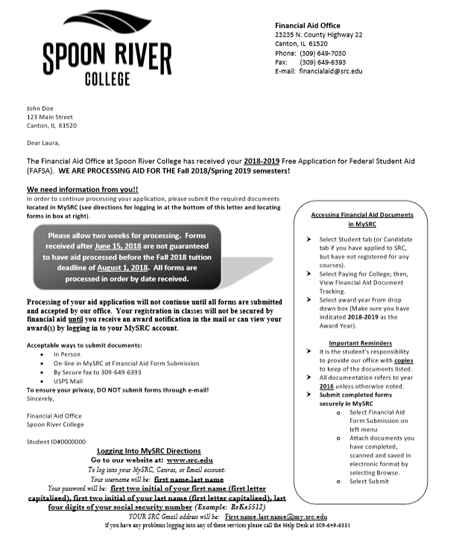

After the FAFSA is received by Spoon River College a letter will be sent to your mailing address on file with the school. An example of this letter is to the right. Please read this letter carefully and return all needed forms.

You will also be able to view and print needed forms on your My SRC by following the steps below.

Logging on to My SRC:

Your username format is firstname.lastname. If that username has already been assigned to another person, a number will be added to the end (firstname.lastname.1). Example: The name John Wayne Smith would be used to create a username of john.smith, but if that name is already assigned to another person, a sequential number would then be used to create a unique name as john.smith.1.

Password

The student’s default password is the first 2 letters of the first name (first letter uppercase) first 2 letters of the last name (first letter upper case) and the last four numbers of the social security number we have on file. Example: Regarding the above example for John Wayne Smith, his password would be “JoSm1234.”

Accessing Financial Aid Documents in My SRC:

- Click on the Student folder (or Candidate folder if you have applied to SRC but, have not registered for any courses);

- Select Paying for College; then, View Financial Aid Document Tracking.

- Select award year from drop down box (Make sure you have indicated the correct Award Year).

Verification

Approximately 30% of all FAFSA’s are selected by the Federal Processor for verification. You will be contacted by SRC, by mail if your FAFSA was selected for verification or you can check My SRC for your financial aid status. If selected for verification, a verification worksheet, federal tax return or tax return transcripts and W2s are required to determine financial aid eligibility. Processing of your financial aid cannot continue until all required documents are returned to and accepted by the financial aid office.

Please remember to request a copy of your tax return transcript approximately three weeks after you e-file your federal income tax return.

- To obtain an IRS tax return transcript, go to the IRS website and click on the “Get Your Tax Record” link. Make sure to request the “IRS tax return transcript” and not the “IRS tax account transcript.”

- You will need your Social Security Number, date of birth, and the address on file with the IRS (normally this will be the address used when your IRS tax return was filed).

- It takes up to two weeks for IRS income information to be available for electronic IRS tax return filers, and up to eight weeks for paper IRS tax return filers.

- If you are married and you and your spouse filed separate tax returns, you must submit tax return transcripts for both you and your spouse. If you were required to provide parents information on your FAFSA and your parents are married but filed separate tax returns, you must submit tax return transcripts for both of your parents.

Types of Aid Determined by the FAFSA

Gift Aid – Aid that is usually in the form of scholarship and/or grants, assistance that does not have to be repaid.

Federal Pell Grants – Funds for undergraduate college students that covers costs, like tuition, fees, room, board and living expenses; eligibility is based on financial need.

- Pell Lifetime Eligibility – The amount of Federal Pell Grant funds a student may receive over his or her lifetime is limited by a new federal law to the equivalent of six years of Pell Grant funding. Since the maximum amount of Pell Grant funding a student can receive each year of full time enrollment is equal to 100%, the six-year equivalent is 600%.

- You can log on to the National Student Loan Data System Student Access Website using your FSA User ID and Password to view your Lifetime Eligibility Used (LEU). The LEU will be found on the Financial Aid Review page.

Supplemental Education Opportunity Grant (SEOG) – grant for undergraduate students with exceptional financial need.

Monetary Award Program (MAP) Grant – grant that provides payment toward tuition and mandatory fees only. Eligibility is based on financial need. You must be in at least 3 credit hours and be an Illinois resident. MAP will only pay for two attempts of a course.

Spoon River College Foundation Scholarships – The SRC Foundation and Spoon River College offer a wide variety of scholarships each year. Scholarships may be for academic excellence or for talent or skill. Some scholarships are named after individuals who wish to continue making a difference in the lives of others. Some scholarships are for a particular profession or degree. To view more information including the application form please visit our SRC Scholarship page.

Self–Help Aid – Aid includes work opportunities and loans and is a form of aid that requires you to take a bit more responsibility.

Federal Work Study (FWS) – This program allows you to earn money while you’re in college through a job available on campus. Campus jobs pay at least the federal minimum wage and eligibility is based on financial need. You may apply by visiting the SRC Employment webpage, select ‘Current Openings’, and then select the appropriate Student Workstudy Employee link in the list of current openings.

Loans – Student loans are also considered financial aid and must be repaid and should always be considered as a last resort for paying for college.

Federal Direct Stafford Loans – Subsidized (need-based) and unsubsidized loans for undergraduate and graduate students attending at least half time (6 credit hours).

Federal Direct Plus Loan – Loans for parents borrowing on behalf of dependent students attending at least half time (6 credit hours), and for graduate/professional students borrowing on their own behalf.

For more information about types of Federal student aid visit the Federal Student Aid website.